Automated taxes.

Maximized savings.

At Lettuce, we’ve built an automated tax and accounting system so your business-of-one can thrive. If you're making $100K, you could be overpaying by $10,000.

.png?width=400&height=401&name=Lettuce_HomeTopRow-min-600-min%20(1).png)

Healthcare for Solos is Here

With Lettuce Pro, you already unlock major tax savings through your S Corp. Now, you can also access revolutionary healthcare powered by Curative. Unlock PPO coverage with a $0 deductible, no co-pays, no out of pocket costs.

Secure May 1, 2026 coverage — enrollment closes March 31. Joining qualifies as a life event, so you can switch now without waiting for open enrollment.

.png)

Meet Lettuce.

Say hello to Lettuce, a system that sets up your business as an S Corp and works 24/7 to reduce your taxes. With Lettuce, you can stop stressing out about managing your taxes and accounting because we’re doing all that for you, all year long.

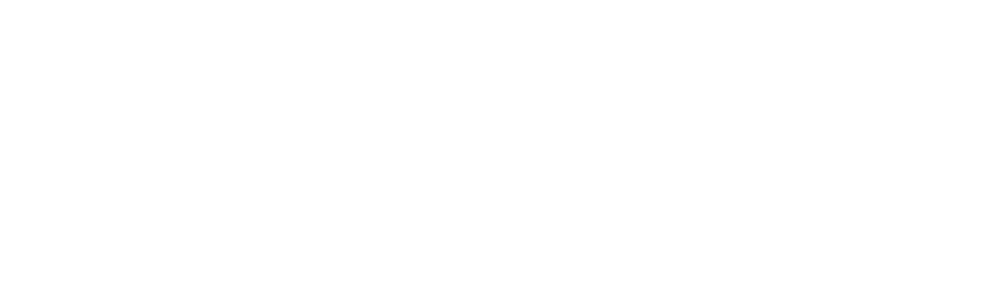

Make the tax system work for you

When you work for yourself, you overpay your taxes by default. Lettuce can help you understand the playbook that will save you thousands each year.

See your whole business in one dashboard

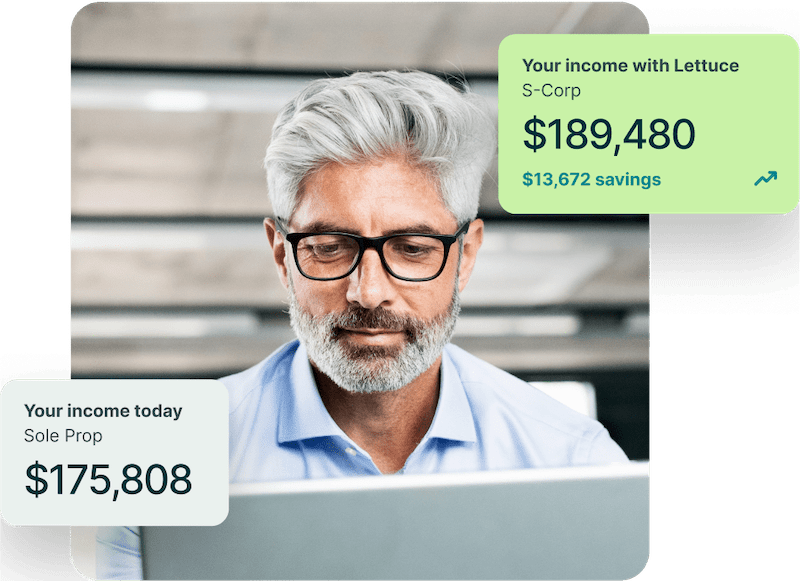

Lettuce is not another DIY solution. Your automated system handles your bookkeeping and accounting with no special setup. No more tracking expenses, no complicated software to navigate.

See How It WorksAlways know what's yours to keep

Not only does Lettuce maximize your savings, it automates your tax withholding and payments, so you can stop worrying about how much you might owe and when.

Without an S Corp, you’re overpaying your taxes

As a business-of-one, by default your self-employment taxes–which covers things like Social Security and Medicare–are twice what they would be as a W2 employee.

Big tax thinking

for small and mighty businesses

Big companies have accountants working around the clock to make sure they get to keep more of what they earn. Join one of our free webinars in March to learn more about the benefits of becoming an S Corp.

Join a Free Webinar

Get answers to your tax questions

Everything you need to know, in 30 minutes

Understand how solopreneurs can keep more of what you earn. Understand if an S Corp with Lettuce is right for you.

Join a Free Webinar

The Lettuce Savings Guarantee

Lettuce will calculate your estimated yearly savings based on your income, your state, and your tax filing status. The Lettuce-Back Guarantee promises that you will meet or exceed this number, or you’ll get a full refund, hassle free.*

"Having one solution that automates all my bookkeeping and accounting gives me a new sense of confidence and saves me so much time."

Lisa Dini, Marketing Consultant

"I feel at ease knowing that Lettuce is taking care of all the hard legal and accounting work I didn't have time to dig into or understand."

Sam F, Business Owner

“With Lettuce, I’m keeping more of every dollar I earn. The ROI speaks for itself.”

Brenden Grace, Fractional CTO