Convert Your LLC to an S Corp with Lettuce

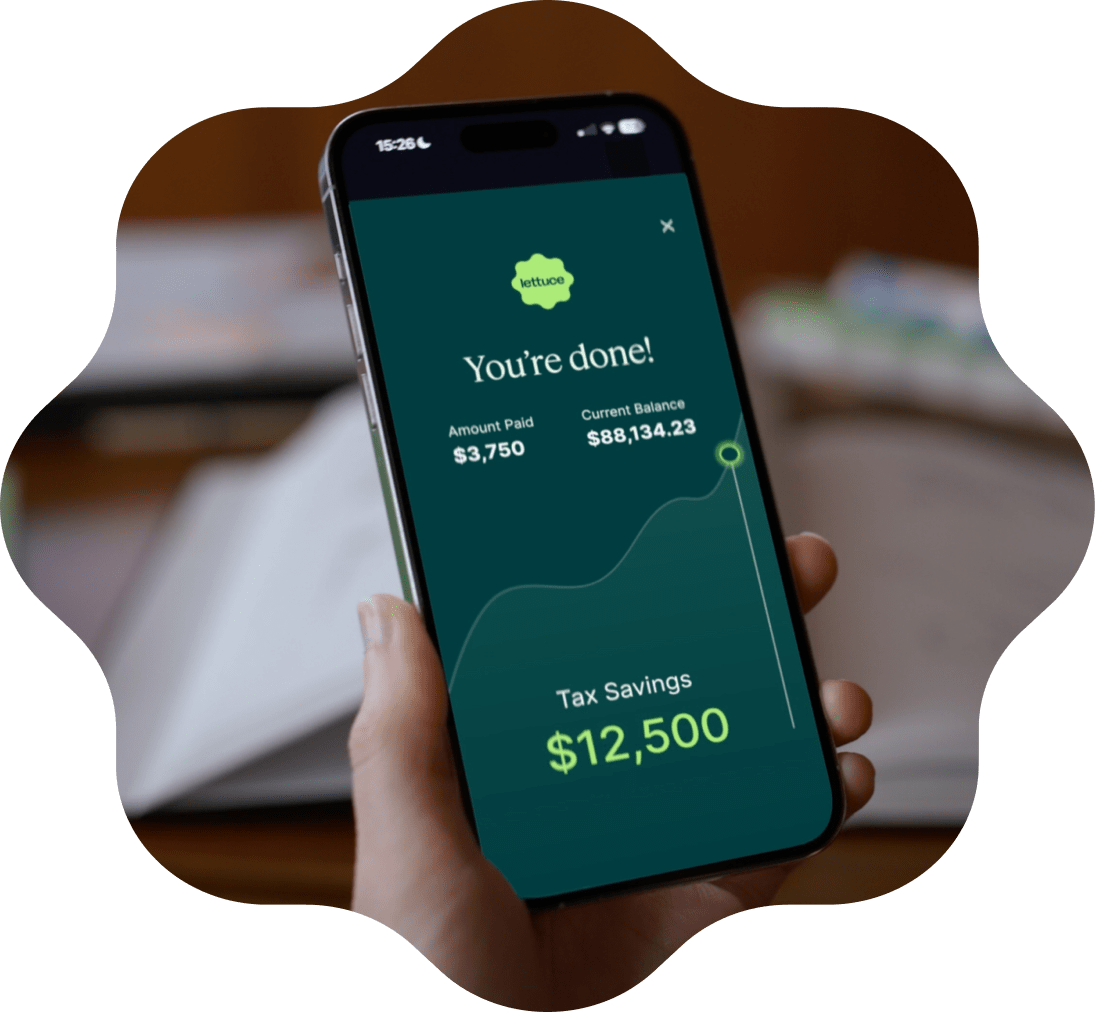

Lettuce is the only system built to form and automate your solo S Corp accounting, helping our customers save $15,000 on average on their taxes.

An S Corp Election Unlocks Tax Savings

An S Corp is a tax election for your LLC that lets you pay less self-employment tax

What it is

LLC

A legal structure

S Corp

A tax election for an LLC

What it does

LLC

Protects your assets

S Corp

Lowers your self-employment tax

Best for

LLC

Lower income or side hustles

S Corp

Solo owners earning $70K+

Lettuce Handles the Switch. You Get the Savings.

If you’re a consultant or freelancer with serious income, you shouldn’t be spending hours figuring out taxes and payroll. Lettuce takes care of it all:

| Paperwork-free S Corp election, at no cost | |

| Auto-run your payroll and auto-pay your taxes | |

| Automate your bookkeeping and accounting | |

| All for one flat monthly fee |

Lettuce is the only automated S Corp solution

Complete S Corp management

Auto-pay your taxes

Maximize your deductions, like vehicle and travel expenses

Pay contractors, vendors, and invoice clients

Plan for retirement with a Solo 401k

Free annual business tax preparation

Is Lettuce a fit for your business?

Lettuce can help you minimize your taxes and maximize your profits. Take the quiz to see if your business-of-one makes is a fit for Lettuce.

"Having one solution that automates all my bookkeeping and accounting gives me a new sense of confidence and saves me so much time."

Lisa Dini, Marketing Consultant

"I feel at ease knowing that Lettuce is taking care of all the hard legal and accounting work I didn't have time to dig into or understand."

Sam Faillace, Business Owner

“With Lettuce, I’m keeping more of every dollar I earn. The ROI speaks for itself.”

Brenden Grace, Fractional CTO

See how much you could save with an S Corp

Forming an S Corp can help you minimize your taxes and maximize your profits. Use our calculator to find out how much could you be saving.

Calculate Your SavingsFree VIRTUAL EVENT

Join our S Corp Info Session

Join us for a free online workshop to ask questions about how an S Corp could be right for you.

Gabrielle Tenaglia, Speaker

Lettuce Head of Marketing & S Corp Owner

RSVP to Secure a Spot

Reserve your spot now to learn everything you need to know about S Corps.

A system that pays for itself

Your tax savings are guaranteed with Lettuce or we will refund your fees. Your subscription quite literally pays for itself, and then some.

Best for Most Businesses-of-One

Lettuce Pro

$299 /mo*

|

No credit card required Cancel anytime without penalty Pay nothing until your clients pay you 100% tax deductible Backed by the Lettuce Guarantee* |

FAQs

-

How do I know if Lettuce is right for me?

Lettuce is a good fit for you’re dissatisfied with a manual accounting and focusing on deductions as tax strategy.

Lettuce is specifically for businesses-of-one based in the U.S., focused on selling services--consulting, creative work, software development, therapy, legal services are all great examples.

You can be set up as a sole propietor or as an LLC and your business can be new or existing.

-

What makes Lettuce unique?

Lettuce is the only automated S Corp solution. No other platform offers this uniquely specialized guidance, and automates the work for you.

First, we exclusively specialize in taxes and accounting for businesses-of-one. Our recommendations are tailored to your needs, and personalized for each individual business based on what you earn, what you spend, and what your goals are.

Second, we do it all with modern technology. There is no off-shore accountant group involved, just a team of dedicated technology professionals, working hard to solve your challenges.

With Lettuce you can focus on running your business instead of spending your time on bookkeeping and accounting.

-

How much time does it take to set up Lettuce?

It takes about five minutes to provide Lettuce with all of the information that is needed to set up your business as an LLC, file your S Corp Election, and open your business bank account. From there, Lettuce handles all of the paperwork and set up on your behalf.

-

Is Lettuce difficult to use?

Lettuce is simple and intuitive. There's no complex software to learn or complicated functionality, so you can focus on your business and not your accounting.

Using Lettuce takes minimal time, about thirty minutes every month.

-

How does the Lettuce Guarantee work?

We are so confident in our work that if you don’t save on your taxes, we will refund your fees. To learn more, see our Guarantee page.

-

How is doing my taxes different with Lettuce?

Instead of crunching at tax time, Lettuce is managing your taxes proactively every day, looking at every dollar of income and expense automatically.

Everything is kept updated in real time throughout the year, so that your balance with the IRS is as close to zero as possible. The work and anxiety around tax season disppears with Lettuce. When the time comes, we will send you all the info needed to file your tax return, including the business tax filing form 1120S and Schedule K1.

Additionally, Lettuce automatically sets aside money from each client payment for your quarterly taxes, making it simple to make your estimated payments.

-

How does Lettuce ensure accuracy for my taxes?We guarantee the accuracy of our work. Our team of tax experts uses proven, best-in-class strategies to help you save more. If our work is challenged by the IRS, we’ll be first in line to defend it at no charge to you. If you’re audited by the IRS, Lettuce will assist you through any audit.

-

Is my data secure with Lettuce?

We take data security and privacy extremely seriously at Lettuce. Lettuce ensures the highest security standards for your financial data, using encryption and secure protocols. Our approach to product development ensures our customers are in control of their data and that their information is safe at all times.

Additionally, our Lettuce guarantee provides assurance that your taxes will be accurate and that we'll defend our work if challeneged by the IRS. Each bank account is FDIC insured up to $250,000.